30+ Current 15 year mortgage rates

A 30-year fixed-rate home loan is a mortgage that will be completely paid off in 30 years if all the payments are made as scheduled. Most of the time there are not pre-payment penalties with a 30-year fixed mortgage so you can always pay off your mortgage more quickly and put additional money toward principal without being locked into a shorter-term fixed loan.

Home Loans St Louis Real Estate News

Current Redmond 15-Year Mortgage Rates on a 220000 Home Loan.

. See Todays Current 30 Yr Mortgage Rates. With a fixed-rate loan the interest rate remains the same for the entire span of the mortgage. For today Wednesday September 07 2022 the national average 15-year fixed mortgage APR is 5350 up compared to last weeks of 5230.

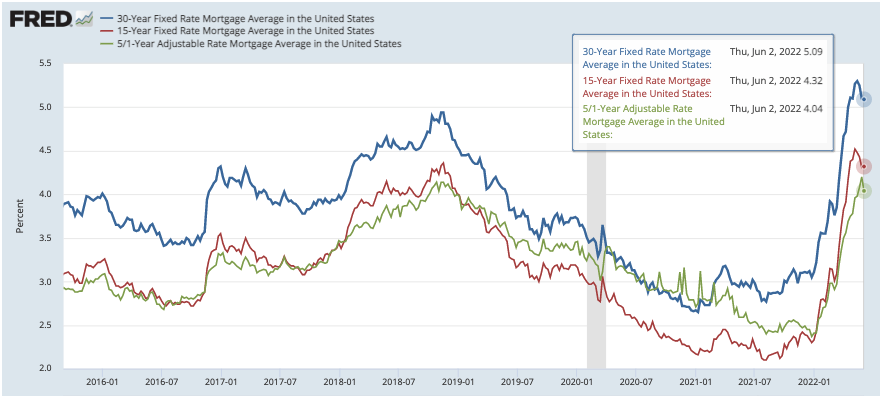

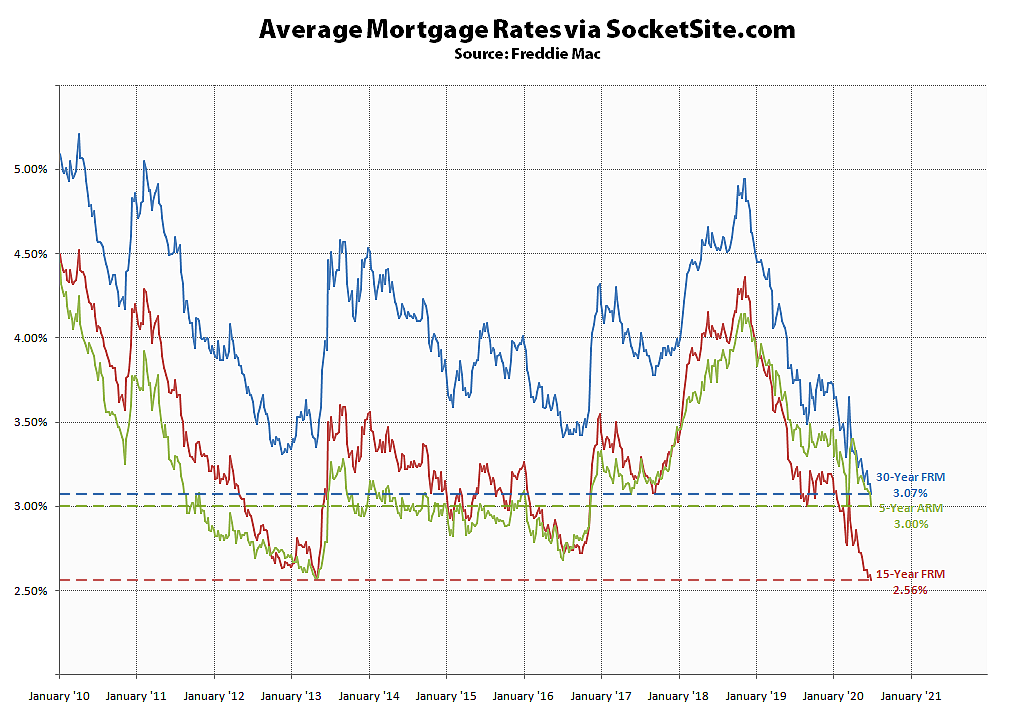

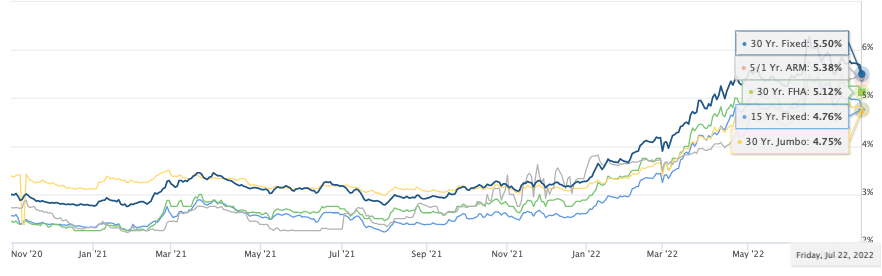

Compare current mortgage rates. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily Freddie Mac etc. Interest only mortgage rates are commonly 1 higher than 30-year rates.

The average rate for 2021 was 296 the. The average APR rose on a 30-year fixed mortgage today inching up to 618 from 608. The average rate for 2021 was 296 the.

When talking about a 30-year fixed-rate mortgage it typically refers to conventional loans. Current 30-year mortgage rates. However getting out from under a monthly mortgage payment 15 years earlier while building equity in your home faster could still be enticing especially for first-time.

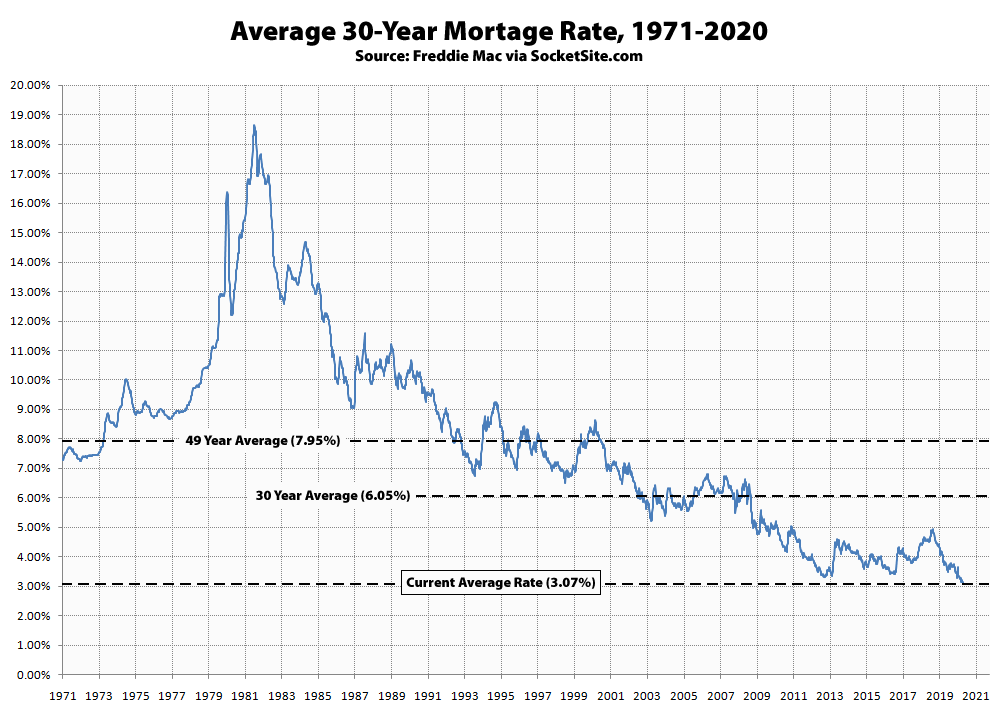

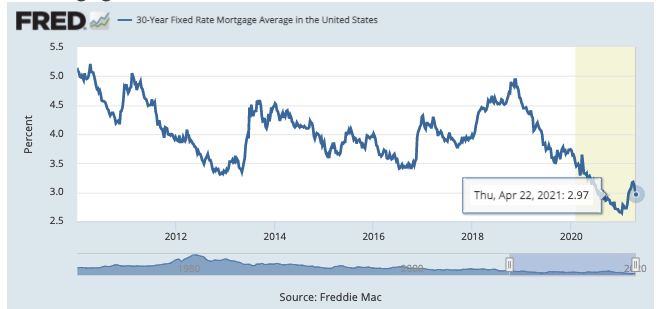

This guarantees the same amount so you need not worry about rising. Although you will end up paying more in interest overtime the 30 year term can allow you to contribute to other areas. The following graph shows historical data from the Freddie Mac Primary Mortgage Market Survey.

What this means. The average APR on a 15-year fixed-rate mortgage fell 5 basis points to 5185 and the. A year before the COVID-19 pandemic upended economies across the world the average interest rate for a 30-year fixed-rate mortgage for 2019 was 394.

Tighter budgets tend to favor a 30 year loan because it offers more predictability and a lower monthly payment than a 15 year fixed rate mortgage Added Liquidity. Heres how their refinance options compare. At the same time the 15-year fixed mortgage APR is 540 higher than it was at.

Unlike adjustable-rate mortgages loans with fixed-rates do not change even if general market rates increase. Youll wind up paying more in interest over the life of a 30-year mortgage than. A 15-year fixed mortgage sits at 538 a 296 rise.

Todays national 15-year mortgage rate trends. This home loan has relatively low monthly payments that stay the same over the 30-year period compared to higher payments on shorter term loans like a 15-year fixed-rate mortgageIf you prefer predictable steady monthly. Chart represents weekly averages for a 30-year fixed-rate mortgage.

The most popular loan option is the 30-year mortgage but 15- and 20-year terms are. Below are todays average 30-year fixed interest rates. At the time they refinance current rates for a 15-year mortgage are at 225 while 30-year fixed rates are averaging 275.

Is a 30-year fixed-rate mortgage right for you. Compare the latest rates loans payments and fees for 30 Year Fixed VA mortgages. 30 Year Mortgage Rate is at 566 compared to 555 last week and 287 last year.

A year before the COVID-19 pandemic upended economies across the world the average interest rate for a 30-year fixed-rate mortgage for 2019 was 394. 30 Year Fixed 15 Year. The 30-year fixed-rate mortgage is 26 basis points higher than one.

Rates on a 15-year mortgage tend to be slightly less than a 30-year mortgage. A 30-year fixed-rate mortgage is by far the most popular home loan type and for good reason. Find and compare 30-year mortgage rates and choose your preferred lender.

A year before the COVID-19 pandemic upended economies across the world the average interest rate for a 30-year fixed-rate mortgage for 2019 was 394. Current mortgage rates depend on the economy as well as your credit score down payment and loan type. 30 Year Fixed 15 Year Fixed 30 Year FHA 30 Year Jumbo 51 ARM 30 Year VA 30 Year Jumbo Mortgage Rates Average 30 year fixed JUMBO mortgage rates from Mortgage News Daily and MBA.

A year before the COVID-19 pandemic upended economies across the world the average interest rate for a 30-year fixed-rate mortgage for 2019 was 394. It shows historical rate data back to 1971 for the 30-year along with 15-year data back to 1991 and 51 ARM data from 2005 onward. Todays average fixed rate for a 15-year mortgage is 523 compared to the average of 519 a week earlier.

Homeowners looking to refinance may find that 15-year terms offer the best opportunity. There are many different kinds of mortgages that homeowners can decide on which will have varying interest rates and monthly payments. Historically the 30-year mortgage rate reached upwards of 186 in 1981 and went as low as 33 in 2012.

Historical mortgage rates chart. A year before the COVID-19 pandemic upended economies across the world the average interest rate for a 30-year fixed-rate mortgage for 2019 was 394. The average rate for 2021 was 296 the.

Average for 2022 as of August 26 2022. Current 30-Year Fixed Rates. Compared to a 30-year fixed mortgage 15-year fixed rate rates are usually lower by 025 to 1.

Current Mortgage Rates. The average rate for 2021 was 296 the. The average rate for 2021 was 296 the.

For interest rates as of June 2022 a 30-year fixed-rate mortgage sits at 618 a 315 rise from the previous year. Mortgage refinance rates fell today bringing 15- and 10-year rates back under the 5 mark.

How Would The Federal Tapering Affect Me Economy Infographic Mortgage Interest Rates Mortgage Payoff

A Refinance Opportunity Has Emerged Mortgage Rates Have Declined

Benchmark Mortgage Rate Nearing An Unprecedented Mark

Home Loans St Louis Real Estate News

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Was Getting An Arm Before Inflation And Rates Went Up A Bad Move

Buyers Strike Mortgage Applications Drop 8 Below 2019 As Home Buyers Get Second Thoughts About Raging Mania Wolf Street

Benchmark Mortgage Rate Nearing An Unprecedented Mark

Calculated Risk May 2013

If Interest Rates Triple What Will Happen To Existing Homeowner S Mortgages And Equity Value And What Happens To Prospective New Homeowner S Costs Downpayment And Mortgage Size Quora

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

What Is The Relationship Between Mortgage Rates And Housing Prices Quora

Home Loans St Louis Real Estate News

Ted C Jones Drtcj Twitter

2

Home Loans St Louis Real Estate News

Home Loans St Louis Real Estate News